Being qualified for Emergency Loans having Unemployed Some body

Refinancing Finance

Refinancing funds are a great way to help you combine personal debt and cut money on desire. Refinancing happens when your change the terms of your current mortgage or take away an alternate financing to settle a vintage one. After you refinance, you could select many selection in addition to down interest rates, longer cost attacks, and/or down monthly installments. Lire la suite

The three-season months doesn’t come with any several months when the newest borrower receives a monetary adversity deferment

(B) New adjusted monthly payment for each and every debtor of the multiplying new computed commission of the fee calculated inside part (b)(1)(ii)(A) from the point; and you will

(C) In the event the borrower’s funds take place from the numerous owners, the brand new borrower’s adjusted payment by the multiplying the fresh commission determined in section (b)(1)(ii)(B) on the area from the part of the entire a good dominant quantity of the brand new borrower’s eligible fund that are stored of the mortgage holder;

All you have to Know When looking for a card Creator Financing

Digital Federal Credit Connection

![]()

Digital Federal Borrowing Relationship (DCU) would depend within the Massachusetts however, now offers qualities to customers nationwide. They supply their borrowing from the bank creator financing to aid customers improve their borrowing from the bank if you find yourself strengthening offers.

You will find several positive points to getting a card creator financing because of DCU. Might enroll in the credit connection. That can instantaneously introduce a banking connection with the possibility supply others, including playing cards, funds, home loans, and you may licenses away from deposit.

DCU will pay dividends to your membership securing the loan. Lire la suite

¿Â qué es lo primero? https://prestamos365.mx/lime24/ sería algún Préstamo Casero?

Productos de tema

Muchos préstamos parientes carecen sobre una conformación formal. Lire la suite

Reimagining the brand new Government Financial Bank operating system

A crucial cog of your own United States’ financial system was at exposure. To have 89 decades, the brand new Government Mortgage Bank operating system has been an established provider of liquidity for the majority of of your own country’s banking institutions, credit unions and you will insurance firms. Instead of important transform, that it outstanding social-individual union is drawing near to the conclusion their benefits.

Established in 1932 when you look at the waning times of the fresh Hoover government, so it detailed framework off eleven – twelve at that time – banks scattered along side You.S. might have been a good bulwark of our own economic climate. Member-owned however, federally offered, this type of 11 finance companies have provided content liquidity on the people courtesy secured enhances. The computer could probably fund alone courtesy debt obligations they issues that carry reduced risk premium considering the created be certain that of one’s federal government.

The house Loan banking institutions that define the machine is actually cooperatively belonging to new loan providers within their areas. This is certainly from inside the stark evaluate due to their distant authorities-sponsored-corporation cousins, Federal national mortgage association and you can Freddie Mac, which were belonging to profit seeking shareholders and therefore are today for the conservatorship. Each Government Financial bank devotes a critical percentage of their net gain to help you reasonable homes also to financial development in the region.

From Great Despair, multiple recessions, new Y2K frighten, new savings and you can loan debacle, or any other stresses throughout the economic places, the computer might have been a constant supply of financial support having monetary intermediaries. Lire la suite

Frequently asked questions On the online payday loans exact same time

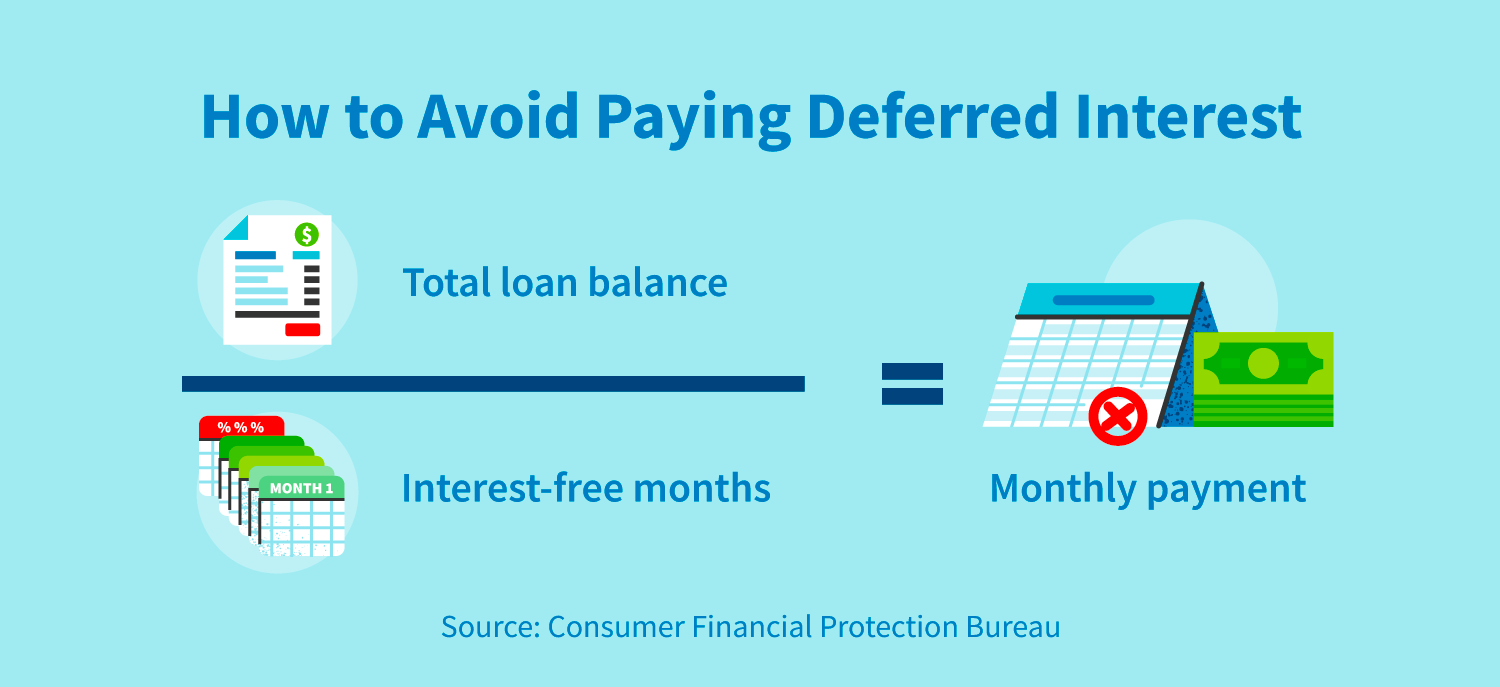

Generally, the lowest loans-to-money ratio ways less exposure towards the bank whilst indicates that you could have the ability to spending over minimal fee in your latest debt each month.

The user Economic Safeguards Bureau prompts tenants to maintain their personal debt-to-income ratio (DTI) anywhere between 15 and you will 20 percent and home owners to keep it ranging from thirty-six and you can thirty-six percent.

Payment per month

Taking out fully financing which have higher monthly obligations may place your power to repay in danger when you’re meeting your own almost every other obligations. Lire la suite

Which Qualifies To have A great Va Build Financing?

In the event that youre a help representative otherwise seasoned whom looking to create your fantasy domestic, you might want to sign up for a beneficial Va framework financing. In lieu of Virtual assistant mortgage loans, never assume all lenders offer these types of finance, and there is a lot of documents involved.

Continue reading to learn more about how to qualify for an effective Virtual assistant framework financing. Its crucial that you observe that Skyrocket Mortgage does not render financing to build our home but can help your refinance on a long-term Virtual assistant mortgage just like the home is over.

What is A great Virtual assistant Build Mortgage?

You are most likely regularly the average brand of Va finance, the place you receive a lump sum payment to order an existing family. But what in the event the youre a recently available solution affiliate, qualifying Federal Shield professionals, an eligible reservist, a qualifying enduring companion otherwise an experienced seeking create your own home?

Therefore, you might getting an excellent applicant for a Va build financing. Va build fund is short-title funds that will help you safeguards the expense of design an alternative home. And you can in lieu of researching one to upfront percentage, Va design finance pay only into the part of your house that is done. You can find many benefits to applying for a great Virtual assistant design financing. For one thing, you will find have a tendency to zero advance payment criteria. And in case you select not to ever generate a deposit, you wont be asked to take-out personal home loan insurance (PMI).

And, some property owners taking aside Virtual assistant build financing is actually exempt away from make payment on Virtual assistant investment fee. Such as for example, there is no capital percentage for these receiving Va handicap otherwise accredited surviving partners. Lire la suite

Guideline: Whenever Should you decide Re-finance Your Home loan?

This simple signal can help you determine whether or not to re-finance

Terri Williams was a professional inside mortgages, home, and you can real estate. Just like the a journalist the woman is secure the brand new « homes » corner out of personal loans for over 10 years, which have bylines from inside the scores of publications, and Realtor, Bob Vila, Google, Time/Second Advisor, New San francisco Chronicle, Actual Belongings, and you may Flat Procedures. Lire la suite

Santander Lender are founded in the 1902 while the Sovereign Financial in the Wyomissing, Pennsylvania

It is a completely-had subsidiary regarding Santander Category, a beneficial Spanish international financial depending when you look at the 1857. The bank will bring an array of financing activities, also fixed- and you will adjustable-speed mortgages, FHA, Virtual assistant, jumbo, consolidation, and structure loans. Lire la suite

Reviews to help you Authorities of your own Government Financial Bank operating system inside Experience of the fresh Observance of your Human body’s 35th Anniversary

This is an incredibly careful and incredibly good point for your requirements to-do. It generates me personally feel good to know that might want to do it–that you find the relationships is such that people normally both concentrate the operate on trying suffice individuals due to the fact it is our very own obligation to serve.

Rigorous currency keeps an incredibly strangling effect on home loan borrowing–as you boys know a lot better than others

We quite often pay attention to into the Authorities regarding the « This is an urgent situation, » or « This is an emergency, » or « Then it a crisis. » Basically drama pertains to united states on term « choice. » We have been decision-making.

Every day you can find choices that i build and you need make with a results towards the prosperity away from the nation, the introduction of the country, and also the general way of living standards of the country. All of us are directly influenced one of the ways or the most other by the almost all of the some thing in our economy–our very own restaurants, the outfits, our very own jobs, and you may our very own casing. I would like to target me personally principally toward coupons and you can funds–in which you have an immediate governmental obligations–and also the general sufferers regarding offers and you may construction within our savings. And i will get–if you have the some time we obtain to they–cam toward more unpleasant subjects, such as for example fees in our savings. Lire la suite